A self-cheque is a cheque issued by an account holder to themselves. It is also known as a self-drawn cheque. The purpose of a self-cheque is to withdraw cash from one’s own account or to transfer money from one’s own account to another account held by the same person.

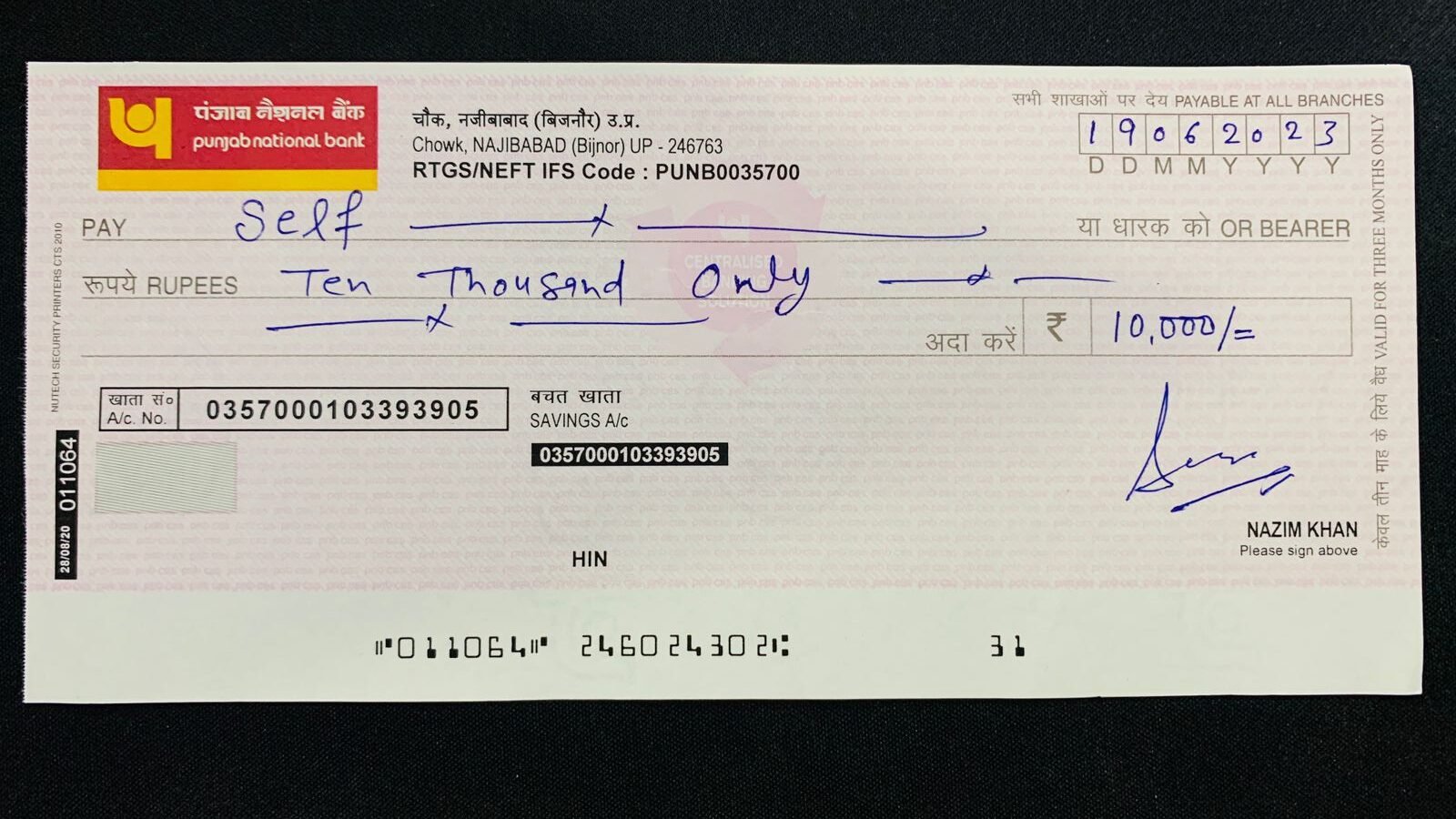

Example of a Self-Cheque:

Suppose you need cash for some urgent expenses, and you have sufficient funds in your bank account. You can write a self-cheque for the amount you need, sign it, and present it to the bank for payment. The bank will deduct the amount from your account and give you the cash you need.

Another example of a self-cheque is when you need to transfer money from one account to another account held by the same person. For example, you may have two accounts in the same bank, and you need to transfer money from one account to the other. You can write a self-cheque from one account, deposit it into the other account, and the funds will be transferred.

Apart from that if you want to print computerized cheques and amaze your business then you can use Excel-based MoneyFlex Cheque Printing software which is fully customized and with Dashboard reports in Excel.

Summary:

In summary, a self-cheque is a cheque issued by an account holder to themselves. It is used to withdraw cash from one’s own account or to transfer money from one’s own account to another account held by the same person. A self-cheque is a convenient way to access one’s own funds or to transfer money between accounts. However, it is important to ensure that the account has sufficient funds to cover the amount of the self-cheque to avoid bouncing of the cheque.